Your Trusted Partner For Accurate, Compliant And Prompt Sales Tax Filings

We offer comprehensive sales tax filing services so you can focus on your business

Your Sales Tax Solution - Multi-State Businesses? or Multiple Locations?

Mayatax is well-versed in sales tax regulations for businesses operating in all states. Our experienced team of professionals stays up to date with the latest sales tax requirements, ensuring that your sales tax filings are accurate and compliant no matter where your business operates. Whether you’re a local business or have a multi-state presence, we have the knowledge and expertise to handle your sales tax filings with ease. Trust Mayatax to navigate the complexities of sales tax filing and help your business stay on top of its obligations.

Testimonials

Maya and Associates are at the top of their game. They know about various tax deductions and credits applicable for different circumstances. They work hard to ensure you receive the maximum tax refund.

Anne Marie

San Antonio Independent

Maya and Associates are at the top of their game. They know about various tax deductions and credits applicable for different circumstances. They work hard to ensure you receive the maximum tax refund.

Anne Marie

San Antonio Independent

Maya and Associates are at the top of their game. They know about various tax deductions and credits applicable for different circumstances. They work hard to ensure you receive the maximum tax refund.

Anne Marie

San Antonio Independent

Reliable, Efficient and Dependable.

We understand the importance of accurate and timely sales tax filings no matter the size of business. Our team of experienced professionals gather data with the utmost accuracy, ensuring that all transactions are accounted for and properly classified.

We take a comprehensive approach to sales tax filings, ensuring that necessary data is collected and reported promptly to meet filing deadlines and avoid costly penalties. Our dedication to completeness and accuracy means that you can trust Mayatax to handle all aspects of your sales tax filings with precision and efficiency, giving you peace of mind and the freedom to focus on growing your business

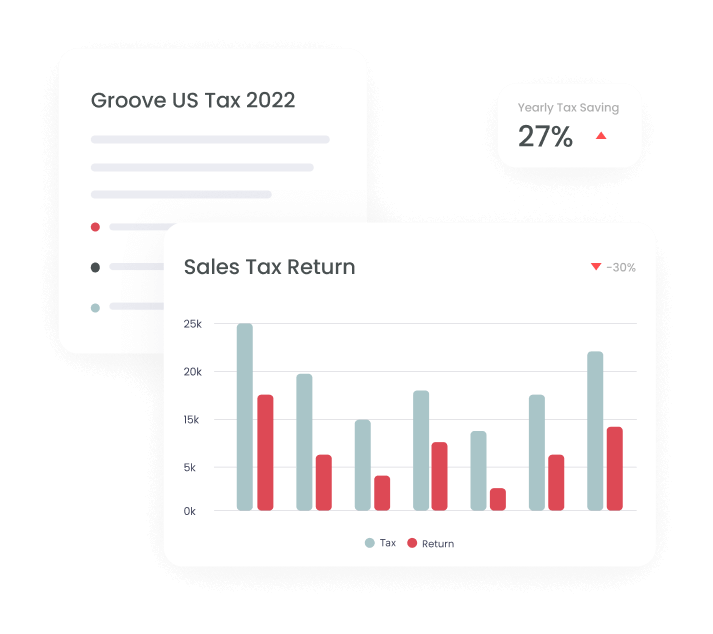

What makes Mayatax Different?

Mayatax stands out from other firms for a variety of reasons. First and foremost, we have a team of experienced professionals who are dedicated to providing exceptional service to our clients. We take the time to get to know our clients and understand their unique needs, so we can provide tailored solutions that work for their specific situation. In addition, we stay up-to-date with the latest government regulations and requirements, ensuring that our clients are always compliant with the local and federal government standards.

The tools and systems that we have in place help streamline our process and provide our clients with accurate and reliable data. Finally, we pride ourselves on our exceptional customer service and personalized approach to each unique situation. At Mayatax, we are committed to helping our clients achieve long-term financial success, we and we go above and beyond to ensure their satisfaction.

Our Sales & Use Tax Consulting Services

We have the expertise to offer the services you need.

Sales and Use Tax Audits

We can assist customers with sales and use tax audits from the IRS by providing expert evaluation, ensuring compliance, and minimizing tax liabilities to avoid penalties.

Nexus Reviews

Running an expanding business as it is, we can help ensure you follow multiple state laws and filing requirements for each one.

Sales Tax Qualification

We conduct a thorough review of your product and service offerings to determine sales tax exemptions which ensures accurate taxation.

Sales Tax Consultation

We offer customized solutions to help your business effectively manage sales tax. We understand the importance of practical guidance that is tailored to your specific business needs.

Why Choose Us?

Speedy and Convenient Services

From consultation, to document gathering, and filing taxes to avoid any penalties for late filing.

Continuous Support

We are here to provide year-round assistance for your agile business environment.

Personalized Tax Planning

We work closely with our clients to create a unique plan that is specifically designed to minimize their tax burden, rather than offering a generic, one-size-fits-all solution.

Our Process

Schedule Your Free Consultation

Book an appointment via our online form or simply give us a call to connect with one of our tax accounting experts.

Send Us Your Documents

Before preparing and filing your taxes, we’ll need to review your financial records and previous tax returns.

Partner With Us

We offer assistance for various types of taxation. Choose the services that you need to grow your business.

Process

Get in Touch With Us

Every business can use some tax help. So schedule your free consultation today by simply giving us a call or submitting your information in the form below.

Tell Us What You Need

We offer comprehensive Accounting and Taxing services, so determine which services you need to improve your bottom line.

Upload Relevant Documents

Give us a green signal, and we’re all on the same page, you can provide us with all the details.

Frequently Asked Questions

The requirements and deadlines for sales taxes vary from state to state. Depending on the estimated sales volume, your state will decide how often you need to file. Generally, the more products a business sells, the more frequently they have to file returns.

The requirements and deadlines for sales taxes vary from state to state. Depending on the estimated sales volume, your state will decide how often you need to file. Generally, the more products a business sells, the more frequently they have to file returns.

The requirements and deadlines for sales taxes vary from state to state. Depending on the estimated sales volume, your state will decide how often you need to file. Generally, the more products a business sells, the more frequently they have to file returns.

The requirements and deadlines for sales taxes vary from state to state. Depending on the estimated sales volume, your state will decide how often you need to file. Generally, the more products a business sells, the more frequently they have to file returns.

Get in Touch With Us Right Away!

Want to streamline your accounting processes? Simply fill in the form below, and we’ll contact you.

For urgent inquiries, please feel free to give us a call.