Struggling with unpaid tax debt and looking for a way to break it into manageable payments? IRS Form 433-D may be the step you need to take. It’s a key part of setting up an installment agreement with the IRS, helping you avoid more aggressive collection actions. If you’re not sure where to start, our income tax services are here to guide you through the process—from choosing the right form to submitting it correctly.

What Is IRS Form 433-D?

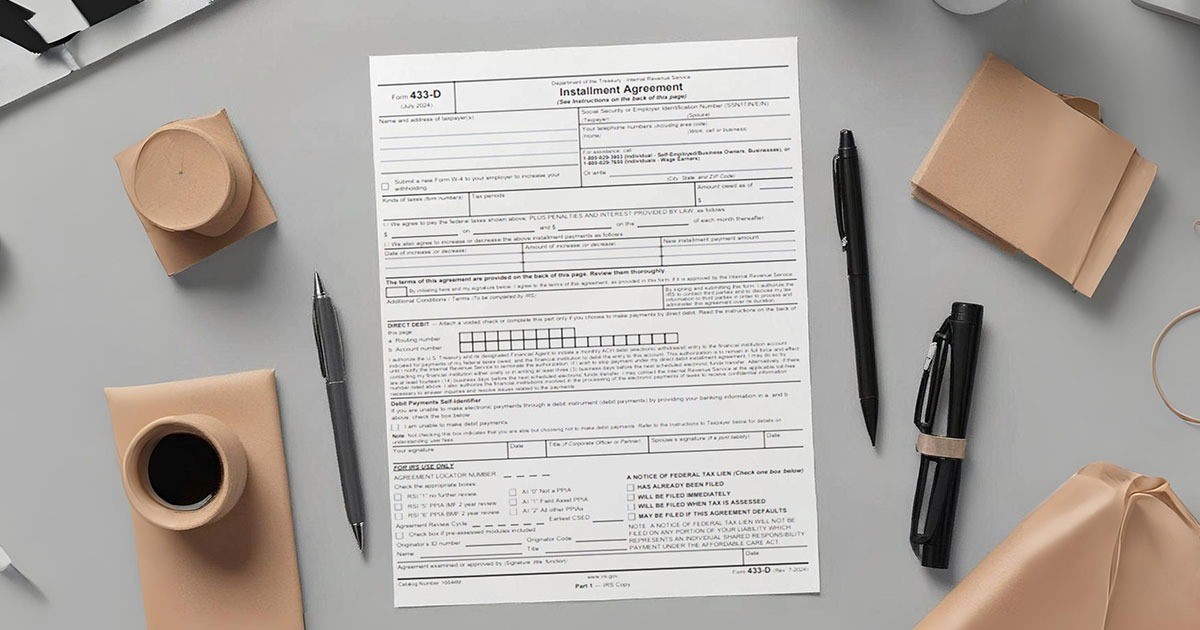

Form 433-D, known officially as the Installment Agreement form, is used to establish a formal payment plan between you and the IRS. Specifically, it authorizes automatic monthly withdrawals from your bank account—commonly called a Direct Debit Installment Agreement (DDIA). This method not only simplifies the process of staying current with payments, but it also reduces the risk of default by ensuring payments are automatically processed.

Unlike some other installment agreements, Form 433-D is particularly valuable because it removes the need to make manual payments each month. As long as funds are available in your account, the IRS will automatically withdraw the agreed amount, helping you avoid missed deadlines and added penalties.

Who Should Use Form 433-D?

You should use Form 433-D if:

- You owe back taxes but cannot pay the full amount right away.

- You want to pay your tax debt through automatic monthly bank withdrawals.

- You’ve previously set up an installment agreement and are converting it into a direct debit plan.

Keep in mind, Form 433-D is commonly used alongside or after submitting Form 9465 (Installment Agreement Request). In many cases, the IRS will require you to complete both if you’re opting for direct debit.

How to Fill Out Form 433-D

To correctly complete IRS Form 433-D and avoid processing delays, you need to provide full and accurate details as outlined below:

1. Taxpayer Information

Enter your full name, current address, and either your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN). If the agreement involves a joint liability, include your spouse’s information as well. Also, provide your home, business, or mobile telephone numbers.

2. Tax Liability Details

List the type of tax (e.g., income tax), the applicable form number (such as 1040), and the specific tax periods covered. Include the total amount owed as of the current date.

3. Payment Terms

Specify the amount you can pay now, the monthly amount you propose to pay, and the date each month (from the 1st to the 28th) that you want the IRS to receive your payment. If applicable, also include planned changes to the payment amount and their effective dates.

4. Direct Debit Authorization (Optional)

If you opt for direct debit, include your bank’s routing number and your account number. This enables the IRS to automatically withdraw monthly payments. Be sure to confirm the routing details with your bank.

If you’re unable to make debit payments, check the appropriate box to indicate that. Not checking the box means you are able but opting not to use debit payments.

5. Review and Signature

Carefully read the terms on the back of the form. Once completed, sign and date the form. If you’re submitting the form on behalf of a business, be sure to include the title of the individual signing the agreement. If it’s a joint liability, your spouse must also sign.

Note: Submit Part 1 of the completed form to the IRS using the address provided in your notice or as instructed.

Where to Send Form 433-D

Where you send Form 433-D varies based on how your installment agreement was set up. If the IRS sent you the form directly, it will typically come with a return envelope or instructions on where to mail it. If you’re submitting it independently or with the help of a tax professional, contact the IRS or refer to the instructions tied to your tax notice for the correct mailing address. Mailing it to the wrong location can delay processing or result in rejection of the agreement.

Tips to Ensure IRS Approval

Here are a few best practices when submitting Form 433-D:

- Review for Accuracy: Ensure all information—especially banking details—is correct to avoid processing errors.

- Make Payments on Time: The IRS expects you to maintain consistent payments. Missed payments can cancel your agreement.

- Stay Compliant: Continue filing all required tax returns while your agreement is active.

- Communicate Changes: If your financial situation shifts, notify the IRS right away to request a payment adjustment.

Smart Way to Tackle Tax Debt with Less Stress

Establishing an IRS installment agreement using Form 433-D can make your tax debt less overwhelming and more structured. By understanding the requirements, staying compliant, and setting up automatic payments, you reduce your financial risk and regain control over your tax obligations. Whether you’re setting up your first payment plan or updating an existing one, working with a trusted team like Maya Tax ensures your paperwork is handled right the first time—giving you peace of mind and more time to focus on what’s next.