If you have experienced debt cancellation, such as from credit cards, mortgage loans, or other personal loans, you might be wondering how it impacts your tax filings. In many cases, the canceled debt is considered taxable income by the IRS. However, Form 982 allows you to potentially exclude this forgiven debt from your taxable income. This is an essential form for anyone who has had debt forgiven and wants to avoid facing an increased tax liability. At MayaTax, we offer expert Income Tax Services to help you navigate this process and ensure your filings are accurate.

In this blog, we’ll cover everything you need to know about Form 982, including when and how to use it, and the steps involved in completing the form properly.

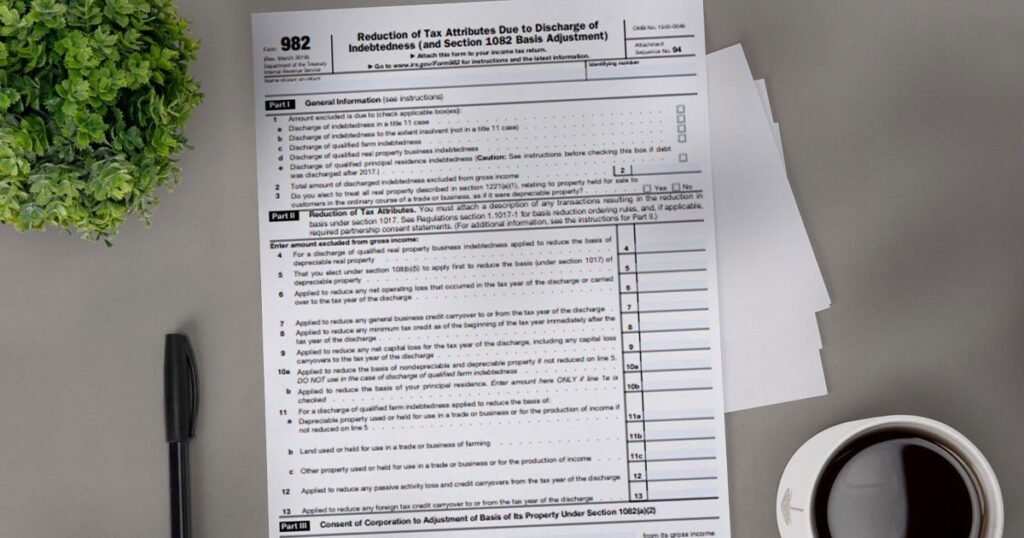

What is Form 982?

Form 982, officially known as Reduction of Tax Attributes Due to Discharge of Indebtedness, is a tax form used by taxpayers who need to reduce certain tax attributes because their debt has been forgiven. The cancellation of debt, whether it happens through bankruptcy, insolvency, or another mechanism, could result in taxable income. However, taxpayers who qualify for exclusions or reductions can use Form 982 to adjust their taxable income, effectively lowering their tax liability.

Filing Form 982 helps taxpayers ensure that the forgiven debt isn’t counted as income on their tax return, which could otherwise lead to a hefty tax bill.

Form 982 Instructions: How to Fill It Out Correctly

Filling out Form 982 involves several steps to ensure you properly report the reduction of your tax attributes. Here’s an overview of how to complete the form:

Part I: General Information

In this section, you’ll need to indicate the reason for the exclusion of discharged indebtedness from gross income. Check the relevant box(es) to indicate the reason for the debt discharge:

- A Title 11 bankruptcy case

- Insolvency (outside of bankruptcy)

- Qualified farm indebtedness

- Qualified real property business indebtedness

- Qualified principal residence debt (only if discharged on or before 2017, as different rules apply thereafter).

You must also report the total amount of discharged indebtedness excluded from income and respond to a yes/no question about treating certain real property as depreciable.

Part II: Reduction of Tax Attributes

Here, you will allocate the amount of discharged debt to reduce various tax attributes. These reductions must follow a specific order and rules set by IRS regulations. The applicable areas include:

- Net Operating Losses (NOLs) from the discharge year or carried forward to that year

- General business credit carryovers

- Minimum tax credit balances as of the beginning of the next tax year

- Net capital losses, including carryovers

- Basis of nondepreciable and depreciable property (except in cases involving qualified farm debt)

- Basis of your principal residence (only applicable if the debt on your principal residence was forgiven)

- Depreciable property, land, or other farming assets (for qualified farm debt)

- Passive activity loss and credit carryovers

- Foreign tax credit carryovers

If basis reduction applies, a description of the transactions leading to this reduction must be attached.

Part III: Consent to Basis Adjustment (for Corporations)

Corporations that exclude discharged debt under section 1081(b) must complete this section. It contains the excluded amount, tax year information, and a consent statement to modify the property’s basis under section 1082(a)(2). A description of the related nonrecognition transactions must also be attached.

Key Considerations When Filing Form 982

When filling out Form 982, it’s important to avoid common mistakes that could delay your filing or lead to incorrect tax results. A few key considerations include:

- Ensure Accuracy: Double-check all your entries before submitting the form. Even a small mistake can cause delays in processing your tax return.

- Keep Documentation: For exclusions like insolvency or bankruptcy, ensure that you keep all relevant financial documents to support your claim.

Had Debt Forgiven? Let Maya Tax Help You File It Right

Canceled debt can easily complicate your tax situation—but it doesn’t have to. If you’re unsure how to properly file Form 982 or whether you qualify to exclude discharged debt from your taxable income, Maya Tax is here to help. Our team ensures every form is filed accurately and on time, so you avoid costly mistakes and stay compliant with IRS rules. Let us take the guesswork out of your tax filing.