Having your Earned Income Tax Credit (EITC) claim denied can be discouraging, especially if you’re confident that you’re now eligible. In certain situations, the IRS may disallow your EITC claim, but if your circumstances have changed, Form 8862 could help you reinstate your eligibility for this valuable tax credit. In this guide, we’ll cover who needs to file Form 8862, how to fill it out, and what to expect throughout the process.

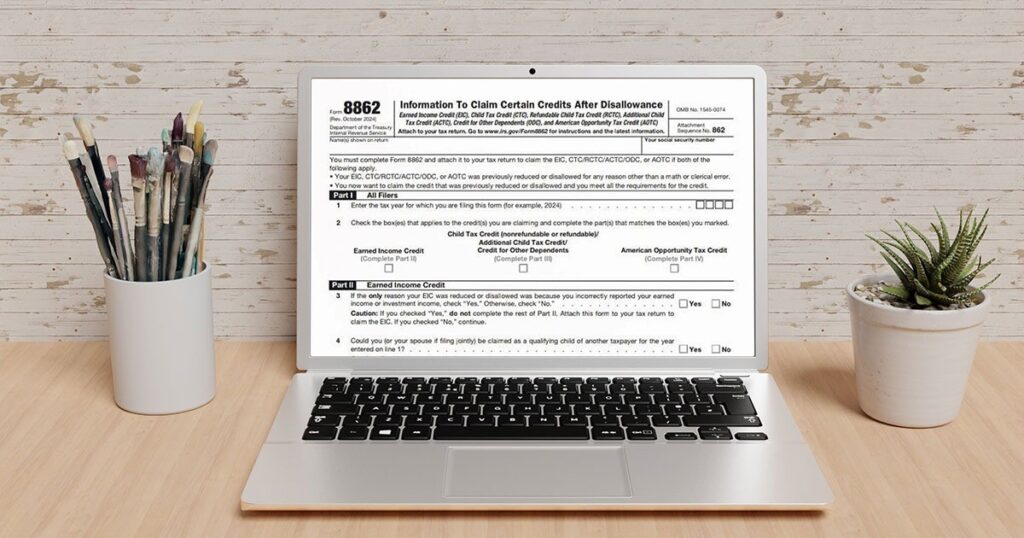

What Is Form 8862?

Form 8862, titled “Information to Claim Certain Credits After Disallowance,” is used by taxpayers to reinstate eligibility for specific tax credits, notably the Earned Income Tax Credit, after a previous disallowance. If the IRS denied your EITC claim in a prior year and you now meet all the qualifications, this form is your pathway to reclaiming the credit.

Who Needs to File Form 8862?

You must file Form 8862 if any of the following apply and your credit was disallowed or reduced for any reason other than a math or clerical error:

- Your Earned Income Credit (EIC) was denied for a year after 1996, and you now meet all the eligibility requirements and want to claim it again.

- Your Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), or Refundable Child Tax Credit (RCTC) was denied for a year after 2015, and you now qualify for the credit again.

- Your American Opportunity Tax Credit (AOTC) was denied for a year after 2015, and you now meet all the requirements to claim it.

You are not required to file Form 8862 if:

- Your credit was disallowed because of a math or clerical error.

- You were denied previously, but not due to intentional or reckless disregard of the rules.

How to Fill Out Form 8862

Completing Form 8862 involves multiple parts that help you reclaim certain tax credits that were previously disallowed:

1. Personal Information

Provide your name, Social Security Number, and indicate the tax year for which you are filing Form 8862. You must also select which credit(s) you are reclaiming:

- Earned Income Credit (EIC)

- Child Tax Credit (CTC), Refundable Child Tax Credit (RCTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC)

- American Opportunity Tax Credit (AOTC)

2. Earned Income Credit (Part II)

Answer questions to confirm eligibility. This includes:

- Whether your credit was previously disallowed due to incorrectly reported income.

- If you (or your spouse) can be claimed as a qualifying child on someone else’s return.

- For filers with qualifying children: details about each child, how long they lived with you, and any birth/death dates.

- For filers without children: information about your (and your spouse’s) residency in the U.S., age, and dependency status.

3. Child Tax Credit / Additional Child Tax Credit / Other Dependents Credit (Part III)

You’ll need to:

- List names of children or other dependents.

- Verify that each child lived with you for more than half the year, qualifies as a dependent or child, and is a U.S. citizen or resident.

- Answer questions confirming the child/dependent meets all the IRS requirements for these credits.

4. American Opportunity Tax Credit (Part IV)

If reclaiming the AOTC:

- Provide student names (as listed on Form 8863).

- Confirm each student is eligible and that AOTC or Hope Credit has not already been claimed for them for more than four prior years.

Note: Form 8862 doesn’t require a signature on its own, but it must be attached to your signed tax return when you submit it.

How to File Form 8862 Electronically

You can file Form 8862 electronically by:

- Using IRS Free File if you qualify.

- Employing commercial tax software that supports Form 8862.

- Working with a tax professional who can e-file on your behalf.

Electronic filing ensures faster processing and reduces the likelihood of errors.

Where to Send Form 8862

If you’re filing a paper tax return, attach Form 8862 to your return and mail it to the address designated for your state, as listed in the IRS Form 1040 instructions. Ensure you use the correct mailing address to avoid delays.

How Long Does It Take to Process Form 8862?

Processing times may vary:

- Electronically filed returns are typically processed within 21 days.

- Paper returns can take 6 to 8 weeks or longer.

Delays can occur if additional information is required or if the IRS needs to verify your eligibility.

Do I Need to File Form 8862 Every Year?

No, you only need to file Form 8862 once after a disallowance, provided your EITC claim is accepted. If your claim is denied again, you must file Form 8862 to reinstate eligibility.

Reclaim Your Tax Credits with Confidence

Reclaiming your Earned Income Tax Credit (EITC) and other credits with Form 8862 is an important step in securing the refund you’re entitled to. While the process may seem complex, filing correctly ensures you don’t miss out on valuable credits.

At Mayatax, we’re here to make the process as straightforward as possible. Our income tax services offer expert guidance to help you navigate the steps of completing Form 8862 and ensure your tax filing is accurate and timely. Don’t let past disallowances stand in your way—reach out to us today for help reclaiming the credits you deserve!